Invoice Factoring

Supply Chain Financing in the US and Internationally

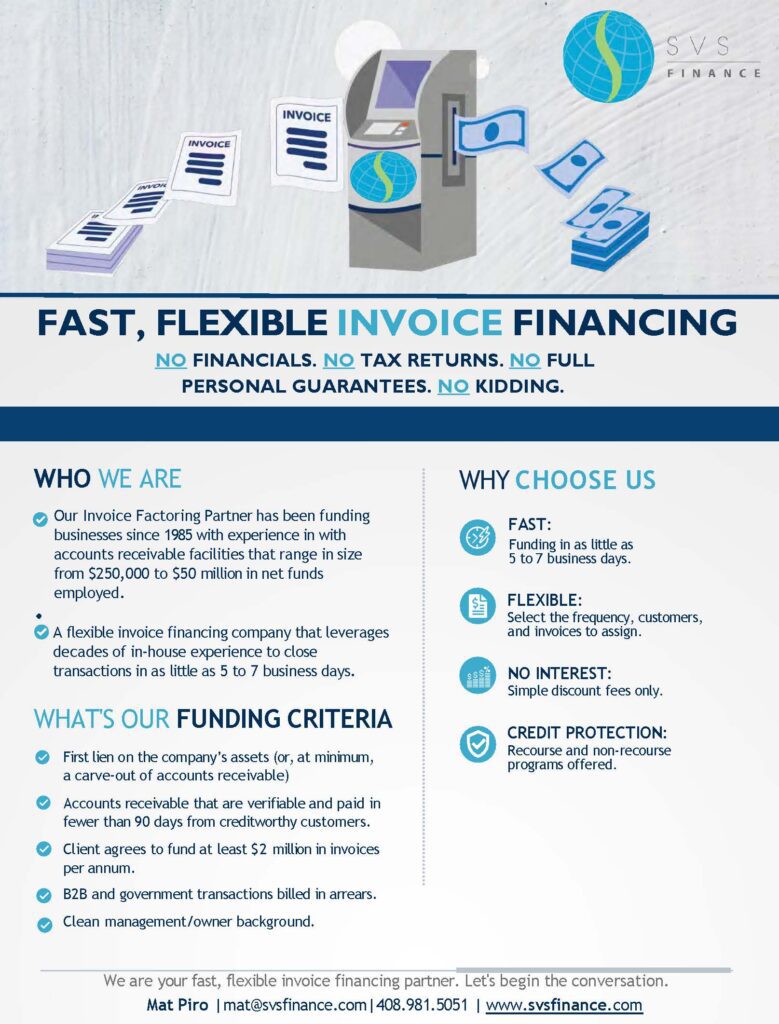

FAST, FLEXIBLE INVOICE FINANCING

NO FINANCIALS. NO TAX RETURNS. NO FULL PERSONAL GUARANTEES.

NO KIDDING.

Our Invoice Factoring Partner has been funding businesses since 1985 with experience in with accounts receivable facilities that range in size from $250,000 to $50 million in net funds employed.

A flexible invoice financing company that leverages decades of in-house experience to close transactions in as little as 5 to 7 business days.

WHAT'S OUR FUNDING CRITERIA

First lien on the company’s assets (or, at minimum, a carve-out of accounts receivable)

Accounts receivable that are verifiable and paid in fewer than 90 days from creditworthy customers.

Client agrees to fund at least $2 million in invoices per annum.

B2B and government transactions billed in arrears. Clean management/owner background.

Fast, Flexible Invoice Financing

At SVS Finance, Inc. we understand the importance of efficient cash flow for businesses. That's why we offer tailored supply chain finance solutions and invoice factoring services to meet your unique needs.

Why Choose Our Invoice Factoring Services?

• Benefits of Invoice Factoring: Improve cash flow, mitigate credit risks, and grow your business without incurring additional debt.

• Competitive Invoice Factoring Rates: We offer competitive rates, ensuring you get the best value for your money.

• Experience: Our Invoice Factoring Partner has been funding businesses since 1985, making us one of the top invoice factoring companies in the industry.

• Fast and Flexible: With our streamlined process, we can close transactions in as little as 5 to 7 business days.

How Does Invoice Factoring Work?

Invoice factoring is a financial solution where businesses sell their accounts receivable (invoices) to a third party (a factor) at a discount. This helps businesses improve their cash flow without waiting for clients to pay their invoices.

Specialized Solutions for All Businesses

• Small Business Invoice Factoring: Tailored solutions for SMEs to boost cash flow and grow.

• Invoice Factoring for Startups: Get the funding you need to take your startup to the next level.

• Invoice Factoring vs. Invoice Discounting: We offer both options, allowing you to choose the best fit for your business needs.

Why our Invoice Factoring Providers are among the Best

Our Factoring Providers commitment to excellence, combined with decades of experience, makes us a preferred choice for many businesses. Though our Factoring Partners, we offer comprehensive invoice factoring solutions tailored to your needs.

Supply Chain Financing: A Game-Changer for Businesses

• Advantages of Supply Chain Financing: Enhance your working capital, strengthen supplier relationships, and optimize cash flow.

• Top Supply Chain Finance Companies: Our reputation and track record speak for themselves.

• Supplier Financing Options: Flexible solutions to suit your business model.

• Digital Supply Chain Financing: Leverage technology for faster, more efficient financing solutions.

• Supply Chain Finance for SMEs: Customized solutions for small and medium-sized enterprises.

• Reverse Factoring in Supply Chain Finance: Unlock the potential of reverse factoring to benefit both buyers and suppliers.

• Supply Chain Finance Platforms: Our state-of-the-art platform ensures seamless transactions every time.